This goes to the more than 7% of my customers and interested people in the United Kingdom. I guess you are all aware of the situation arising by the end of this weird year.

If the hard brexit is going to happen it will massively change trading between the UK and the EU. Generally it means that you will pay net prices, without 19% German VAT. But you will have to pay import VAT to the UK, which means plus 20% on the full price including shipping. And shipping will be more expensive from January 2021 as well. I don’t know the rates DHL will charge from January on, but I guess it will be around 20 EUR for a small package (2kg) and around 30 EUR for a 5kg parcel. It could also be that the UK will charge customs on top of the amount.

This means an order with a net price of 100 EUR will massively increase next year. Germany currently has a lower VAT rate of 16%. This means for an order of 100 EUR you will pay 116 EUR plus shipping. Let’s assume a weight of 5kg, so it will be 116 EUR plus 16 EUR shipping. You pay 132 EUR.

From January 2021 it will be 100 EUR plus shipping of assumed 30 EUR, means 130 EUR, plus 20% UK import VAT, 130 EUR + 26 EUR = 156 EUR plus customs (if applied). You see that this is a massive change of roughly 20%.

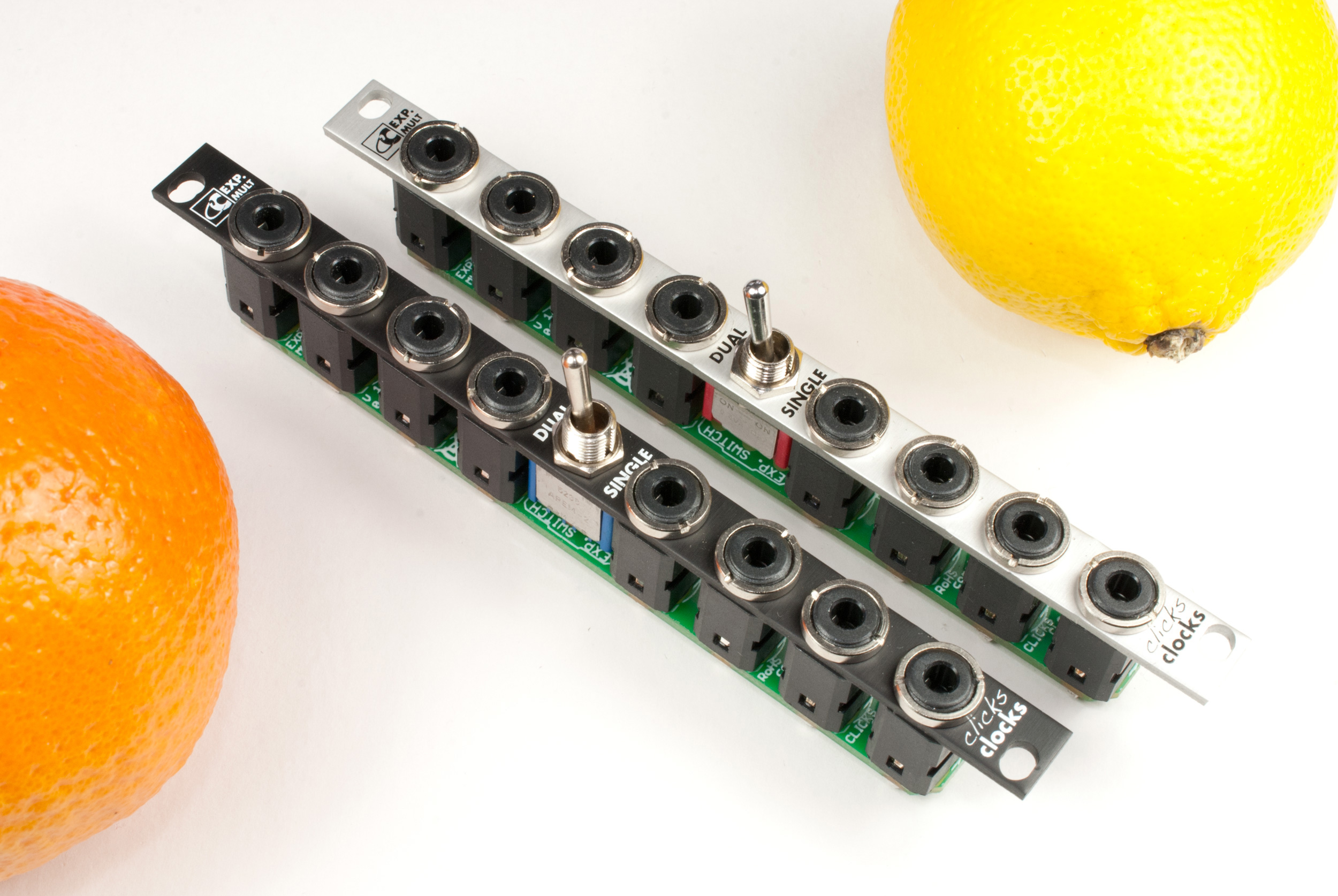

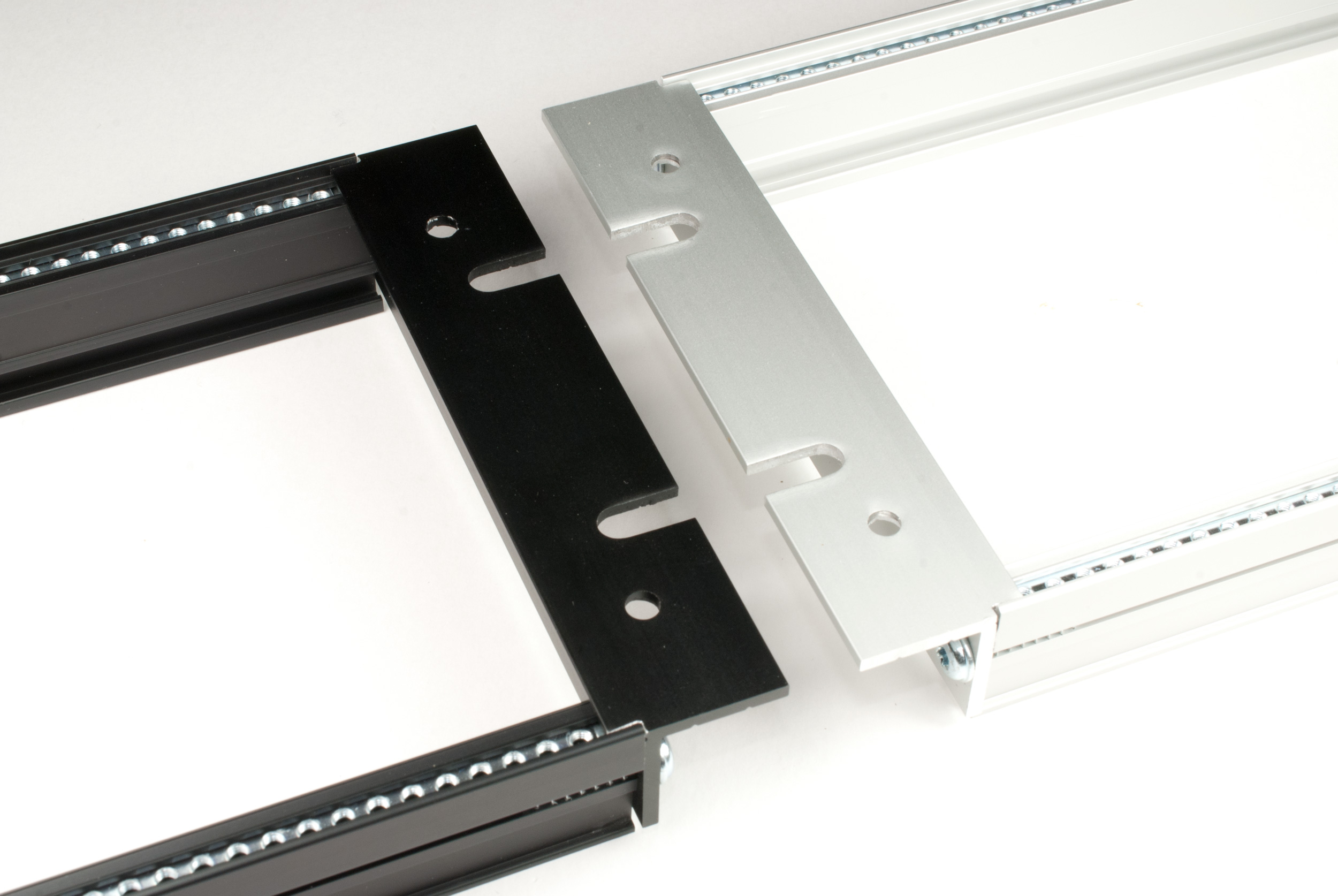

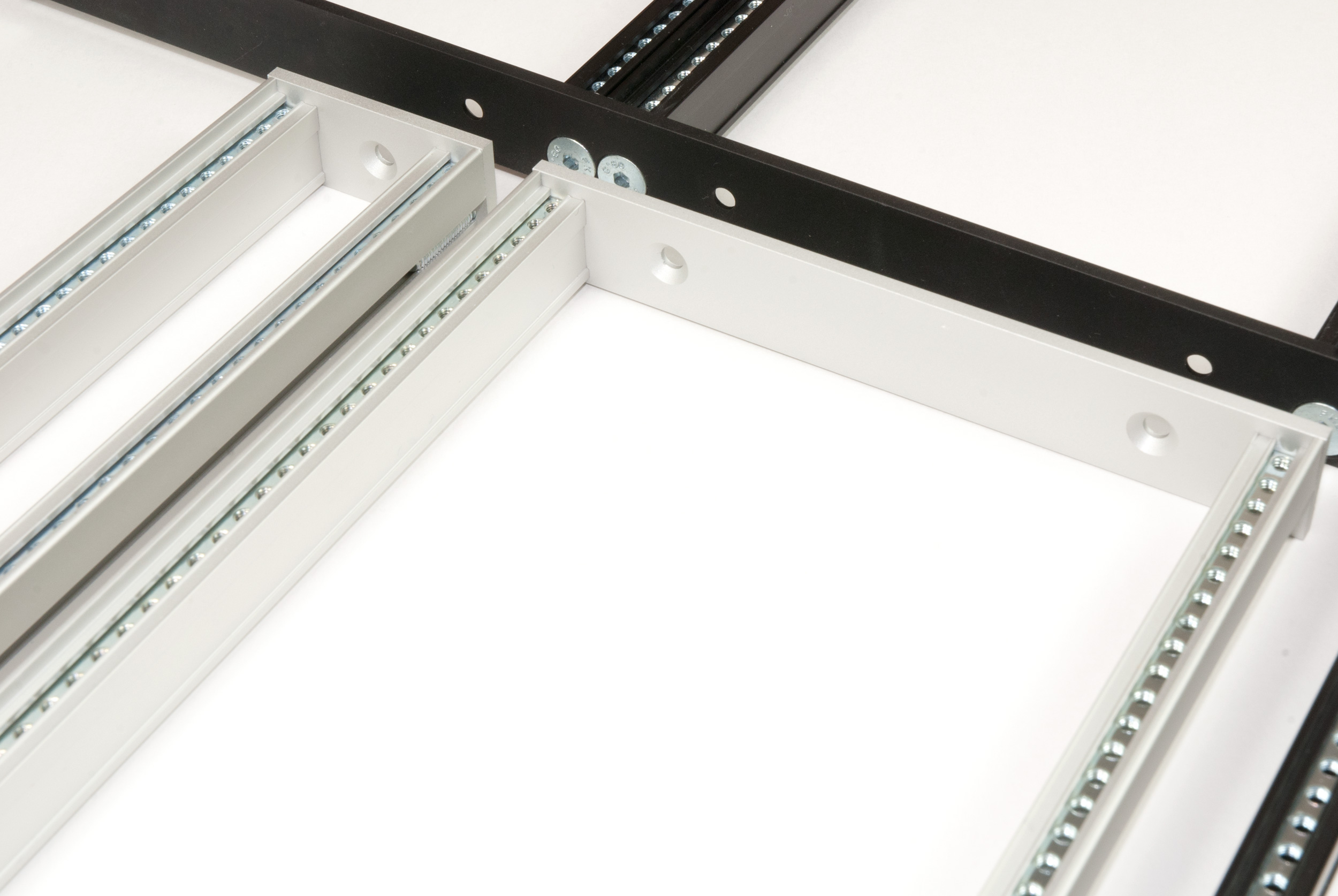

If you are planning to build a Eurorack case, and want to buy some parts, you should probably do it this year. So I would kindly ask for you requests till the 20th of December. Otherwise I cannot guarantee that I will be able to ship before the end of this year. My business year will end before Christmas.

Of course I will continue shipping to the UK, but don’t tell me I didn’t warn you 🙂